The Only Guide for Personal Loans Canada

Table of ContentsSome Known Factual Statements About Personal Loans Canada A Biased View of Personal Loans CanadaThe smart Trick of Personal Loans Canada That Nobody is Talking AboutThe Basic Principles Of Personal Loans Canada Some Of Personal Loans Canada

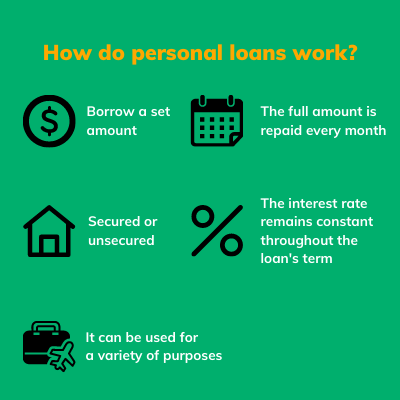

Payment terms at many individual car loan lending institutions range in between one and 7 years. You receive every one of the funds simultaneously and can use them for nearly any type of function. Customers usually utilize them to fund a property, such as a vehicle or a boat, settle financial obligation or assistance cover the cost of a significant cost, like a wedding celebration or a home renovation.

A set price provides you the security of a foreseeable month-to-month settlement, making it a preferred option for combining variable price credit report cards. Payment timelines vary for individual lendings, yet consumers are often able to pick repayment terms between one and 7 years.

The Basic Principles Of Personal Loans Canada

The charge is usually subtracted from your funds when you complete your application, minimizing the amount of cash money you pocket. Individual financings prices are extra directly connected to brief term prices like the prime price.

You might be used a reduced APR for a shorter term, due to the fact that lending institutions recognize your equilibrium will certainly be repaid quicker. They might bill a higher rate for longer terms understanding the longer you have a finance, the most likely something can transform in your funds that could make the payment expensive.

A personal loan is also an excellent choice to using credit rating cards, considering that you borrow money at a fixed price with a certain reward day based on the term you choose. Bear in mind: When the honeymoon is over, the regular monthly repayments will certainly be a suggestion of the cash you invested.

Rumored Buzz on Personal Loans Canada

Before handling financial debt, use an individual funding repayment calculator to aid spending plan. Gathering quotes from numerous loan providers can help you spot the most effective offer and possibly save you passion. Contrast rate of interest rates, charges and loan provider credibility prior to looking for the loan. Your credit score is a huge useful link factor in establishing your eligibility for the lending along with the rate of interest.

Prior to using, know what your rating is so that you understand what to expect in regards to costs. Watch for surprise charges and charges by checking out the lending institution's conditions page so you do not wind up with less money than you need for your economic goals.

They're easier to qualify for than home equity financings or various other protected loans, you still need to show the loan provider you have the methods to pay the financing back. Individual finances are far better than credit score cards if you want a set month-to-month settlement and need all of your funds at when.

Indicators on Personal Loans Canada You Should Know

Bank card may be better if you need the adaptability to attract money as needed, pay it off and re-use it. Charge card might additionally provide benefits or cash-back options that individual financings do not. Ultimately, the most effective credit rating product for see post you will depend on your money habits and what you require the funds for.

Some lenders might also charge fees for personal finances. Individual car loans are car loans that can cover a number of personal costs.

As you invest, your readily available credit scores is decreased. You can then increase readily available credit scores by making a payment towards your credit limit. With a personal financing, there's normally a set end day by which the funding will be repaid. A line of credit, on the other hand, may continue to be open and readily available to you indefinitely as lengthy as your account remains in great standing with your lender - Personal Loans Canada.

The cash obtained on the lending is not have a peek at this website exhausted. If the loan provider forgives the financing, it is considered a terminated financial obligation, and that quantity can be strained. A safeguarded individual lending requires some type of collateral as a condition of borrowing.

The 9-Minute Rule for Personal Loans Canada

An unsecured individual car loan calls for no security to obtain money. Banks, credit rating unions, and online lending institutions can use both secured and unsecured personal car loans to qualified debtors. Banks normally think about the latter to be riskier than the former due to the fact that there's no security to collect. That can indicate paying a greater rate of interest for an individual loan.

Again, this can be a financial institution, credit scores union, or on the internet individual financing lending institution. If approved, you'll be given the car loan terms, which you can accept or turn down.